- About

- Programs

- Issues

- Academic Freedom

- Political Attacks on Higher Education

- Resources on Collective Bargaining

- Shared Governance

- Campus Protests

- Faculty Compensation

- Racial Justice

- Diversity in Higher Ed

- Financial Crisis

- Privatization and OPMs

- Contingent Faculty Positions

- Tenure

- Workplace Issues

- Gender and Sexuality in Higher Ed

- Targeted Harassment

- Intellectual Property & Copyright

- Civility

- The Family and Medical Leave Act

- Pregnancy in the Academy

- Publications

- Data

- News

- Membership

- Chapters

Winter 2024: The Higher Ed Data Juggernaut

A Prescription for Financing Higher Education

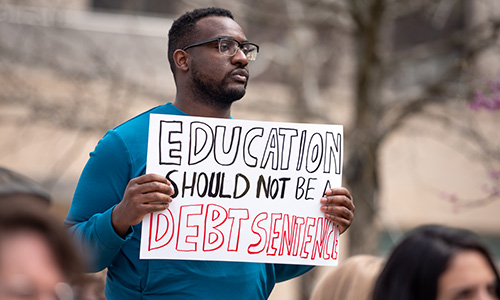

On forgiving student debt and broader reforms.

Tens of millions of Americans across the country carrying $1.7 trillion in federal student loan debt are facing life-changing financial burdens in the aftermath of the June 2023 Supreme Court decision against debt relief. They aren’t taking it well. President Biden’s plan to cancel a big chunk of student debt—$400 billion—did not pass constitutional muster with the court’s conservative majority, and, as a result of recent debt-relief legislation, the loan payment holiday in place since early in the pandemic ended in August. Contemplating the double whammy hitting those in debt is not for the faint-hearted.

What makes matters worse, though, is that we’re not framing the issue right: student loan debt is not solely an individual problem; it is a societal one. We look to higher education to help advance society’s need for equity, educational attainment, economic growth, and social stability. Since society benefits it should help to bear the cost. How are we doing on that score? Not so well.

As French economist Thomas Piketty argues in his consequential Capital in the Twenty-First Century, education is the only politically plausible force that can disrupt inequality. When members of a society become better educated, many of its less wealthy citizens acquire knowledge, a “crucial form of capital” that, Piketty writes, “can bring enormous returns.” Indeed, as New York Times columnist David Leonhardt observes, “the great income gains for the American middle class and poor in the mid-to-late 20th century came after this country made high school universal and turned itself into the most educated nation in the world.” But we’ve been moving away from the policies and the investments needed to continue to make such progress pay off for all.

This is a wake-up call, for sure, and it’s a big deal. The opportunity that higher education provides for securing jobs, accumulating capital, and gaining upward mobility is well-known. Accordingly, society must commit to ensuring that higher education is accessible and affordable for all who seek and can benefit from it. There is a “spreading benefit” at its core, moreover, for a college education is more than an economic benefit to an individual citizen. It is a public good.

The rising cost of higher education—and the burden students are taking on to pay for it—presents an obvious question: Why is there a largely unpayable $1.7 trillion debt in the first place? The narrow approach currently used to determine individual financial need and eligibility for federal support fails to provide insight. Tax and other policy considerations, not to mention laws that benefit the privileged over those in need, rarely surface in this context. They should.

Discussions regarding higher education financing tend to take place in a separate political sphere from those focusing on inequality. That needs to change if we mean to ensure educational opportunities for all.

Expanding the Focus

Framing loan debt in terms of individual costs and benefits—holding that those who attended college have a reasonable expectation of higher lifetime earnings and should therefore pay for it—sidesteps the question of equity and, regrettably, invites politicization. And backlash against Biden’s plan, some of it pernicious, came relentlessly. Betsy DeVos, secretary of education under President Donald Trump, called the plan “deeply unfair to the majority of Americans who don’t have student loans.” She failed to mention why some people have college degrees but don’t have loans: wealth, family support, and favorable tax policies. And the nation’s interest in an educated populace didn’t even get a nod.

In order to look at financial support from a different perspective, we might consider President Lyndon Johnson’s acknowledgment, in his commencement address at Howard University in June 1965, that a level playing field simply does not exist: “You do not take a person who, for years, has been hobbled by chains and liberate him, bring him up to the starting line of a race and then say, ‘you are free to compete with all the others,’ and still justly believe that you have been completely fair.” Noted economist William E. Spriggs, preeminent among others, later identified systemic issues that continue to fuel inequities for Black Americans, including persistent discrimination.

As New York Times reporters Sarah Mervosh and Troy Closson have demonstrated, “For many students, the greatest barriers are practical: applying to, paying for, and completing college.” And it isn’t getting easier, especially for students who want to pursue higher education but are barely surviving on the margins.

Federal loan policy has become more problematic as institutions of higher education, receiving less government support, have shifted to greater reliance on tuition-based revenue models, loading more costs on students and, as a result, increasing reliance on student loans. Student debt is also high because the cost of higher education has risen, yet the promise of earning a job in a labor market that would enable full loan repayment has not been realized by many borrowers. The prospect of secure employment worsened during the pandemic, leading many to rely on temporary forbearance because of loan obligations they could not pay.

Some holders of student loans carry balances greater than the sums originally borrowed, an unrelenting burden that is unlikely ever to end. Despite progress on some fronts, including the rising minimum wage, economic inequality and racial inequality remain high—and paying off student loans weighs heavily in the calculus.

Who Benefits from Current Policy?

Criticism of the Biden student-debt-relief program did not extend to other federal programs like the 529 college-savings plans, from which many students and their families benefit, even across generations. These are costly plans, given the state and federal tax benefits they provide, but that cost—as with others that taxpayers bear indirectly, such as federal subsidies for sugar and for farmers—don't wind up in the criticism column where Biden’s “too costly” debt-relief program did.

Writing in the New York Times, Ron Lieber observes that “people with hundreds of thousands of dollars to spare can create 529 accounts that will end up holding millions of dollars. With careful planning, no taxes will come due for most people so long as future generations use the money to pay for college.” Enhanced plans, dubbed Dynasty 529 plans, can ride for a long time, with investments of funds, and accumulations of tax-free interest, financing the college educations of future generations.

Currently, the 529 plans are attracting even more investors, not least because of recent enhancements: the funds may now be used for all educational costs prior to college or to repay student loans, and money not used for education can be rolled into a Roth IRA for the plan’s beneficiary—up to $35,000.

Overall 529 plan assets, reflecting deposits and investment gains, reached almost $409 billion in the first quarter of this year! We’re comfortable with the tax-favored savings given to millions of people who can more easily afford to pay for college education, yet a majority of Supreme Court justices struck down a debt-relief program for those who needed loans.

Contrast the ease of using 529 plans, moreover, with what students and their families go through to qualify for loans. The loan application process is a tough slog, especially for borrowers without guidance on various plans, rates, and terms, including additional hassles like annual renewals and reenrollment and recertification requirements. Why design programs to provide assistance and then add layer upon layer of requirements that discourage students and their families from applying for it? Outsized requirements for proof of eligibility for financial aid—making the bar high—suggest a lack of trust in, or certainly a weak commitment to, those who need support for their higher education.

The student loan industry should not escape scrutiny. It bears responsibility for adding to the debt burden—for example, by virtue of its preference for capitalizing accrued interest to add to loan balances.

Federal Policy and the Social Order

The United States has created a system that favors those who are better off and have greater political influence through tax breaks and benefits. We could reimagine the proper distribution of resources in our society, but the insistence in some quarters on imposing work requirements on assistance programs and cutting school lunch programs, for example, while also resisting any relief for students from their loan debt, has not been met with an alternative vision for how we might structure our social safety net.

As it is now, those who need help the least get the largest breaks from the federal government when it comes to saving and paying for college. It is the poor, Black, and brown students who don’t get the breaks and will suffer the most if some student debt relief is not granted. All too often, these students do not complete their degree requirements; even if they don’t gain that promised economic edge, they are saddled with the cost of their loans. As the Biden administration’s debt-relief announcement noted, “Nearly one-third of borrowers have debt but no degree, according to an analysis by the Department of Education of a recent cohort of undergraduates. Many of these students could not complete their degree because the cost of attendance was too high. . . . The student debt burden also falls disproportionately on Black borrowers. Twenty years after first enrolling in school, the typical Black borrower who started college in the 1995–96 school year still owes 95% of their original student debt.” Relief for these students has been hard to come by.

But consider what happened when President Obama tried to tax future earnings in the 529 accounts in 2015, in an effort to rein in the extent of the benefit and generate tax revenue. The blowback from the wealthy and the upper middle class was so severe, from Democrats and Republicans alike, that he rescinded the plan in the same month he introduced it. However tempting it may be to take away or reduce certain benefits, it’s important to keep in mind that doing so is often impractical and politically risky.

We may resist eliminating sources of moral hazard in the economy, but we should at least aim to be more even-handed in the way we provide “assistance” and strive for policy integrity, bending toward an egalitarian moral economy, one that also looks to ensure public well-being and advance the common good.

Priorities and Policy Options

Addressing the lack of capital among Black and brown families must be a priority as structural and systemic causes contribute to gaps in generational wealth, presenting barriers to millions of Americans. This is nothing short of a national imperative.

Research by the Federal Reserve Bank of New York on racial differences in debt indicates that Black individuals are more likely than their white counterparts to hold student loan debt by the time they are thirty years old in part because Black students are less likely to receive help paying for college from parents or grandparents who have less wealth. Racial disparities in student loan debt are particularly relevant to racial wealth gaps since differences in education level are often identified as causes for these gaps and therefore as an area for potential solutions.

Bloomberg reporter Kathryn A. Edwards succinctly proposes, “End the reliance on traditional loans and switch to a model in which the state becomes a sort of equity partner in individuals’ education, footing a large part of the bill and receiving payments tied to the income that graduates manage to earn.”

Some other ideas for shifting the burden of the cost of higher education from the individual to society—and changing the ways that states and individual institutions can help pay for it—include the following:

- Expanding tax reforms that generate funds to support the cost of structural changes to higher education financing

- Offering a federally funded variation on the 529 plans for low-income families—with weight given to their capacity to contribute and with interest accumulating tax-free—to pay for education and related costs

- Developing a variation on the “baby bond” proposals that would commit the federal government to funding an investment vehicle for each child born to a low-income family and contributing to it over time to yield a sum the beneficiary can use for educational costs

- Continuing to improve existing income-driven repayment plans—with borrowers paying a lower percentage of their discretionary incomes for a period of years after which the remaining balance is forgiven—by setting monthly student loan payments at amounts that are affordable based on income and family size

- Creating an automatic option that handles all loan payments through the tax withholding system, much like Social Security contributions, to simplify debt management

- Restructuring student loans and lowering interest rates, currently 5.5 percent on federal student loans for undergraduates and ranging from 4 to 14 percent on private student loans

- Mitigating adverse conditions that may have hampered the progress of low-income student applicants by considering them as a factor in admissions and giving these students a break in tuition and related costs—as well as academic assistance while at college—to improve their prospects for earning a degree

- Reducing costs for students who need assistance by simply lowering tuition and fees based on income level—not only at wealthy, selective colleges and universities but also at other private and public colleges and universities

Structural Changes

As the Supreme Court ended race-based admission policies with a decision issued just a day before its majority decision on debt relief, the stark reality confronting the nation became more evident, particularly as underperforming schools and communities with heavy concentrations of minorities have become choice recruiting targets for achieving diversity in colleges and universities. The major shift we need, as I argued in an op-ed after the court’s decision, is “action to make inroads against the deep, persistent problems that prompted the need for affirmative action policies in the first place.” Affirmative action programs did not end, as some had anticipated they would, because we failed to invest resources to make structural changes that might have eliminated the need for them. And there is still a critical need to improve schools and provide complementary support to aid student progress.

The stakes are high for a nation with deep wounds, persisting racism and inequality, and a widening political divide. The vital importance of higher education for Black and brown citizens—and access to opportunities for jobs, capital accumulation, and upward mobility—could not be clearer. Society must commit to preparing and supporting students in elementary and secondary schools and precollege programs. And higher education institutions, in their admissions considerations, should give weight to the future benefits to society from educating talented students from all backgrounds.

The nation, in short, needs to confront the fundamental structural and systemic barriers in place for Black and brown citizens if we are serious about acting on the nation’s commitment to equal opportunity. Investing in our people, in those who seek and can benefit from an educational opportunity, will require that we earnestly attempt to close the wealth and income gaps that make access to higher education a step too far for financially challenged applicants. With House Republicans pushing for deep cuts in spending, our work is certainly cut out for us.

The Nation Needs Educated Citizens

Abraham Lincoln invested in colleges as he looked to prepare the nation’s citizens for the future, but his work, as he said, was left “unfinished.” Then higher education was meant to be available only to some; now it’s a promise for all, but it’s a promise that remains only partially met.

Like other nations with which we compare ourselves—nations that bear some or most of the cost of higher education—we need to understand that an educated citizenry is essential to a vibrant democracy and crucial in sustaining a cohesive, pluralistic society as well as a healthy economy. Whether we can reverse our present course remains to be seen, but we have the ways and the means to do it.

Linda Stamato is a senior policy fellow at the New Jersey State Policy Lab and cofounder and codirector of the Center for Negotiation and Conflict Resolution in the Edward J. Bloustein School of Planning and Public Policy at Rutgers University–New Brunswick.

Image obtained via Flickr, licensed under Creative Commons.